The Ombudsman for Short-Term Insurance (OSTI) and Ombudsman for Long-Term Insurance (OLTI) are independent bodies that clients can contact if they feel that their claim was not treated fairly.

Whereas OLTI shares the number of long-term insurance complaints that were resolved with some benefit given to the complainant (i.e. resolved ratio), OSTI details the number of short-term insurance claims received per insurer, as well as the complaints received by OSTI per thousand claims received (i.e. the referral rate).

Click here to download the 2022 OSTI/OLTI report.

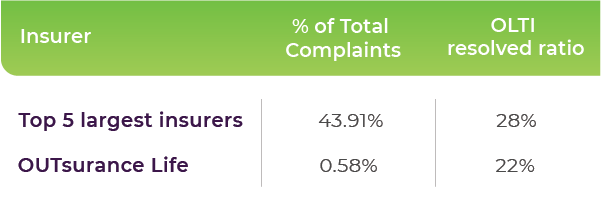

OUTsurance Life beats the average resolved ratio of the top 5 largest insurers

As a challenger brand in the life insurance industry, OUTsurance Life achieved a lower OLTI resolved ratio where a complaint was resolved partially or fully in favour of the complainant, when compared to the average of the five largest competitors in the life insurance industry (based on total assets).

In fact, only 22% of OUTsurance Life’s OLTI complaints were resolved either wholly or partially in favour of the complainant (i.e. client) as opposed to 28% for the top five largest competitors in the industry.

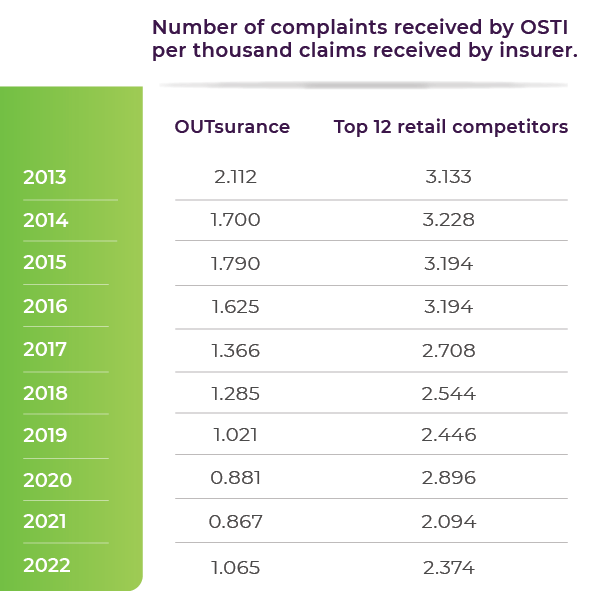

OUTsurance received the fewest number of complaints per 1 000 claims

OUTsurance has, for the 10th consecutive year, beaten the industry average with the fewest number of complaints referred per 1 000 claims, compared to the average referral rate for the 12 largest comparable insurers by claims volumes.

In 2022, OUTsurance received only 1.065 complaints per 1000 claims referred to OSTI, once again outperforming the average referral rate of 2.374 for the 12 largest comparable short-term insurers by claims volume.

Danie Matthee, Chief Executive Officer at OUTsurance said that, ‘These results speak of our unfaltering commitment to paying out claims fairly. Paying claims and making sure our customers always get something out is why we exist, so naturally we are very pleased with the outcome.’

An award-winning insurer

OUTsurance boasts an impressive list of accolades, the most recent of which is the Beeld Jou Keuse/Readers’ Choice 2023 Award where OUTsurance was voted the best insurer by readers of the Beeld newspaper.

In March 2023, OUTsurance was named short-term insurer of the year at the inaugural News24 Business Awards and in May 2023, the 2022/2023 Ask Afrika Icon BrandsTM Benchmark Survey indicated that OUTsurance is South Africa’s preferred brand when it comes to choosing car insurance and home insurance.